Wyckoff theory PDF free download

Wyckoff Theory PDF Free Download: A Practical Guide for Modern Prop Trading

Introduction

If you’re sketching out a trading plan across forex, stocks, or crypto, Wyckoff’s framework still speaks clearly. A well-chosen Wyckoff theory PDF can act like a compact playbook—distilling price, volume, and time into actionable setups. This piece looks at what you can gain from a reputable Wyckoff theory PDF free download, how to tell a legit source from a lure, and how the ideas fit into today’s multi-asset world—where DeFi, AI, and prop trading are reshaping learning curves and opportunities.

What Wyckoff Theory Brings to the Table

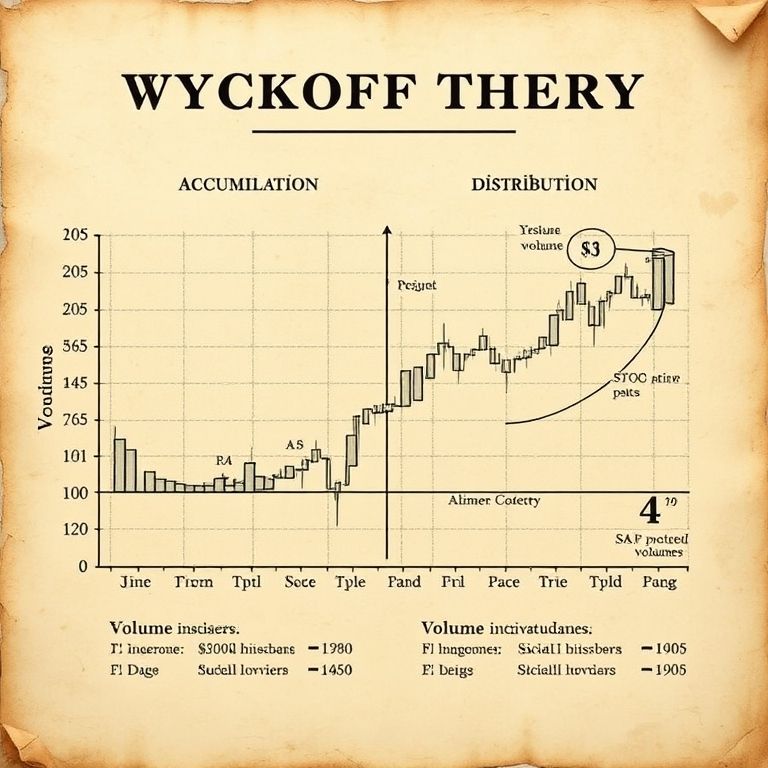

- Price-volume logic: Wyckoff stresses how price moves with volume—sharp upswings often riding on demand, downswings on supply. Expect diagrams showing accumulation, distribution, and their telltale volume bursts.

- Market phases you can count on: preparation, markups, and pullbacks provide a mental model for when to stay in a trade or take profits, rather than chasing every spike.

- Pattern recognition with discipline: price action around support and resistance, with context from volume, helps separate breakouts from fakeouts.

Free PDF Reality: Finding Legit Sources

A “free download” can be a minefield. Look for:

- Authored or endorsed by reputable instructors or institutions; check edition dates to avoid stale content.

- Companion notes or case studies tied to real charts, not just theory.

- Clear licensing and no shady redirects. If a link asks for unusual permissions or passwords, move on.

A solid Wyckoff PDF will include practical examples, bite-sized charts, and pointers to test setups on your own screens.

Applying Wyckoff Across Markets

- Forex and indices: watch how price tests swing highs/lows with volume clusters around those levels; the idea is to identify consolidation zones before a probable move.

- Stocks and commodities: look for accumulation/distribution signatures near major support or resistance and confirm with volume spikes on breakout days.

- Crypto and options: the higher volatility demands tighter risk controls, but the same rhythm—accumulation, markups, distributions—helps you judge entries and exits.

DeFi, Smart Contracts, and AI in Trading

- DeFi’s growth brings multiple liquidity venues and on-chain signals. Smart contracts can automate alerts or even rule-based entry/exit triggers when Wyckoff-friendly patterns appear.

- Challenges exist: fragmented liquidity, security risks, and evolving regulation. Yet, the trend toward transparent order flows and programmable strategies is real.

- AI-driven trading is entering the scene as a companion tool—pattern recognition, backtesting, and risk controls can be enhanced by models that digest Wyckoff-style setups at speed.

Prop Trading Outlook and Practical Takeaways

- The edge today blends solid pattern recognition with risk discipline. Wyckoff-informed setups can align well with capital efficiency, especially when paired with strict position sizing and clear stop rules.

- Cross-asset learning builds resilience: mastering a Wyckoff framework in one market tends to sharpen instincts in others—spotting pullbacks in crypto can sharpen entries in equities.

- Strategy note: combine a Wyckoff-based framework with diversified watchlists, simulated practice, and gradual exposure to leverage, keeping a keen eye on drawdown management.

Slogans to Keep in Mind

- Unlock the Wyckoff edge with a trusted Wyckoff theory PDF free download.

- Turn chart rhythms into repeatable moves—learn, test, and trade with Wyckoff.

- From print to practice: the Wyckoff approach in a modern, multi-asset world.

Bottom line

A well-chosen Wyckoff theory PDF free download can be a practical bridge from classroom theory to real-world trading. As markets evolve toward DeFi, smart contracts, and AI-assisted tools, the core habit—reading price with volume—stays a reliable compass. Keep your sources honest, test ideas with discipline, and let Wyckoff’s timeless patterns anchor your prop trading journey.